Thoughts on the Babylon SPAC

June 10, 2021

Tl;dr;

Babylon appears to be going for the WeWork special - take a low margin business where it’s easy to collect large top-line revenues (in WeWork’s case office rentals, in Babylon’s case fully capitated VBC contracts), add software and then ask investors to value you on revenue multiples like a software company. Babylon is conflating their scalability and growth metrics to make the business look like something it is not.

One interesting area that potentially could be fruitful for Babylon as it moves into medicare advantage world is using its AI and patient engagement tooling to surface and document underlying conditions potentially moving the needle around the covered population’s risk adjustment.

Of concern to the model here is that Babylon intends to recognize top quality margins from selling software to other providers who may be competitors and large revenue volumes from servicing MA populations where its ability to generate margin is unproven.

Does Babylon have a competency in building software to drive down cost in a capitated care setting? Does Babylon have a competency in network composition and care delivery? Assuming the software works well (which is unproven), will other Babylon competitors happily pay fat margins to buy from a competitor?

So let’s get into it. Babylon - who until recently was a venture backed AI chatbot for symptom checking, diagnosis, and triage - now is SPAC’ing as a fully capitated provider servicing medicare advantage plans. I have no beef with Babylon pivoting to focus on MA plans and actually I’m happy to see so much energy around value based care. For background, KO has a good writeup this week on the topic.

What I am concerned about however, is that the “business plan” in this investor presentation feels more like a VC seed pitch than you know the kind of meaningful evidence you would expect from a publicly traded company. This feels particularly like a case of too much VC capital raised and now a need to find one more fool to pass the buck to before imploding.

Apparently, the group sponsoring this SPAC think the public will buy anything - which maybe shouldn’t surprise, since two of the three SPAC vehicle executives are the former CEO and CFO of Groupon. Speaking of which…

From the people who brought you Groupon, Healthcare!

This is going to end well.

Even though buying insurance might feel in some ways like a daily deal (pay in advance, get some kind of voucher, maybe don’t use it, middleman pockets a fat cut..) it’s not! Actually it’s one of the most complicated and challenging industries in the world - heavily dependent on human practitioners, regulated beyond belief, and generally lower margin at all points in the value chain than expected! But hey, at least these guys (and they are all guys) proved they could lose other people’s money once before while reselling goods & services which they do not render themselves!

Let’s start with the “Understanding Babylon in 5 Questions” slide here:

My favorite here is row 4 here - How Do We Monetize It? It’s simple, through clinical services! Oh and software licensing which according to the footnote describes calculation of margins in this way: “Based on a select software licensing contract. Gross Margin includes some technology costs that are classified as operating expenses in the company’s financial projections.”

So they managed to ink at least one software contract at 90% margin if you compute margin by not counting some of the cost. WOW.

NEXT!

Ah yes, the fundamental laws of Value Based Care and Digital Health with Babylon at the intersection. Again, this is a public company, not a pre-seed deck. It doesn’t matter what are existing trends in healthcare. Value Based Care is not some fundamental law of nature to be captured. VBC is not some empirical law like Moore’s (not)Law in computing that just happened to be an observable phenomenon for a long time.

Now here’s some real gold:

Zooming in here:

You can see how Babylon stands out the Scalability axis!

You might wonder what is “Scalability” and why this metric isn’t more common in investment literature. Well it’s because it appears to be just made up! Here’s what the fine print defines it as: “Scalability defined as 2020A-2022E Revenue CAGR plus 2022E Gross margin. 2022E peer data sourced from Factset and CapIQ consensus estimates as of May 7, 2021, except LVGO FY20 and FY22 forecasts based on Factset consensus estimates as of August 4, 2020, one day prior to Teladoc acquisition announcement. TDOC FY20 Revenue proforma for acquisitions. Babylon financials based on management estimates.”

This made up metric is defined as the actual 2020 revenue through the estimated 2022 revenue CAGR + gross margin. But remember above, gross margin is defined as the margin on the software part of the business where the margin on that part of the business is defined as the margin which does not include some of the costs. Oh and the growth is based on management’s guesses. Also Babylon’s growth includes acquisitions but Livongo’s is computed for the day before the Teledoc acquisition.

Moving right along..

The “How We Do It Section” which basically says “telehealth” and also that preventing ER visits reduces costs. Both true! One slide of interest here:

It seems like this presentation is making the case that Babylon has a real competency in digital self care. I understand that theoretically this is the base of the pyramid here and that a competency there will move the needle in all categories above. That said, if I were making this bet, I would be concerned about turn over annually in patient populations and that investments here may not bring reduced cost savings to Babylon.

Moving up the pyramid, in order to be successful here, one would expect Babylon to have some either basic if not dominate competency in each of the other areas:

Personal health assistant: is this type of telemedicine something which Babylon has a competency in? Do we have any information about Babylon’s cost structure and organizational wisdom here?

Clinical consultations: same as above

In person consultation: I am aware that Babylon recently purchased some provider groups. Is this enough to win at MA care provisioning at scale?

Complex care referral: does Babylon have an added value network or is Babylon stuck paying full freight when making referrals?

Babylon Has a Scalable Technology Stack

What is special here? By “scalable” do they mean “software based”? Patents != scalable. AI != scalable. Peer-reviewed papers != scalable.

This is an interesting one:

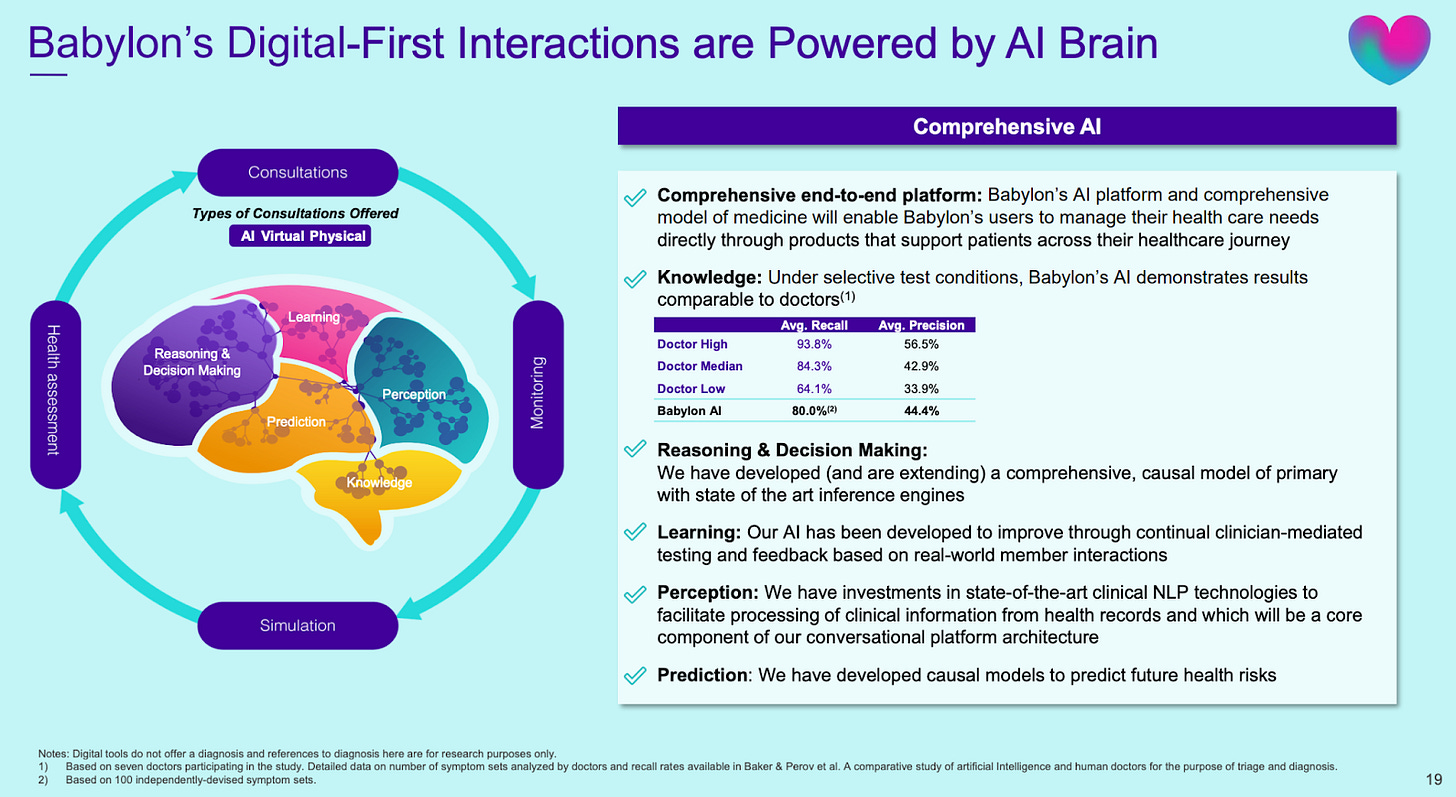

Some points of interest about this comprehensive AI and the statistics shown:

These results are based on a diagnosis challenge where Babylon’s AI competed against a grand total of seven doctors on 100 simulated cases.

Further the cases were all single condition cases.

Perhaps the AI would be better than human doctors when diagnosing complex patients (like the ones who might be most likely to be cost drivers) but who knows?! Perhaps not!

Finally the AI here may not be representative as it’s rare that doctors see patients entirely out of context. Human doctors might have a consult with a patient at a specific type of care facility. I’d be interested in seeing how the AI performs against an instant message conversation, video call, or in-person retail clinic consult without having perfectly structured data available to it. All AI is specific to the context the data was gathered and trained in. It can be a long road to generalizing machine intelligence from one domain to another.

How Do We Monetize It:

“Attractive Illustrative Economics” - it’s good that the illustrative economicsare attractive! My favorite illustrative economic here is the assumption that margin will go up by 600% over three years! And by the way, we don’t know what it is today!

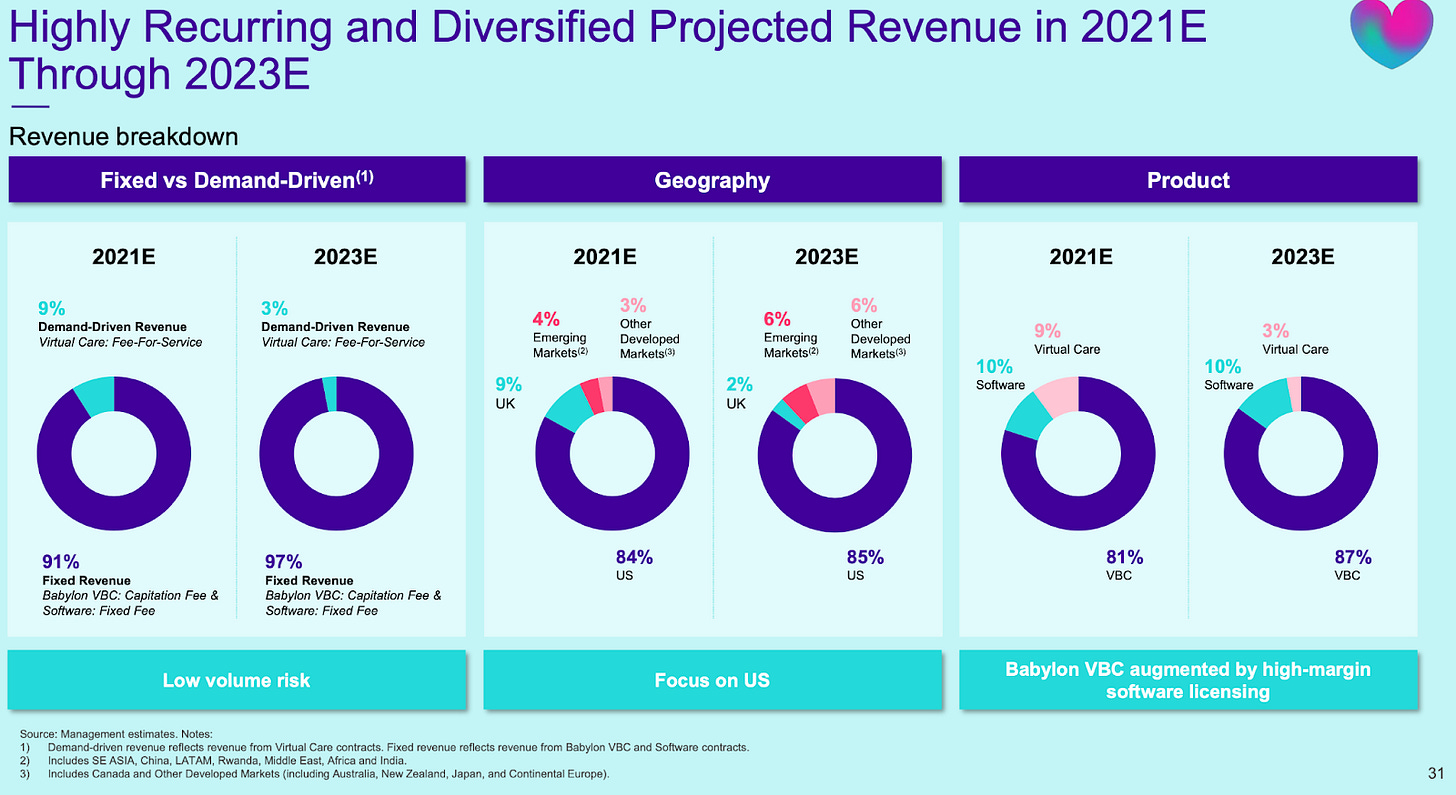

I’m not sure why someone would bother using the word “diversified” here to describe revenue when it’s basically all the same thing - the purple is VBC and US based. Look at all the purple! Very not-diversified!

A couple of things which I do find exciting here:

The AI triage and diagnosis technology seems like it would be a great fit for population profiling and risk adjusting at scale. This alone could materially move the business in a way which makes all the difference. Maybe this is the plan but just not as attractive to share in an investor deck.

An AI & custom software competency could be very valuable at reducing administrative costs. I’d find it more compelling if Babylon sold those tools to their MA plan customers rather than their provider competitors. There are obvious synergies about selling into the same customer base and upselling is often a lower cost revenue segment than new customers - there also is not a conflict of interest which is a large problem in my eyes!

Sounds like an amazing deal for the first party MA plans who essentially capture zero risk value here.

To summarize, here are my concerns:

The technology is unproven

The business does not have a track record of excellent value based care (or this track record is not evidenced in this presentation)

The business does not have a competency of network composition or management - essential competencies for success in a capitated environment (or this competency is not evidenced in this presentation)

The high margin part of the business is a low volume part of the business

The high volume part of the business is low margin (potentially even negative margin) part of the business

The high margin part of the business depends on selling to competitor organizations

The technology which is proven was proven in a different context from the intended use

The opportunity was identified by ex-GRPN execs

Some open questions:

What happens if Babylon becomes a capitated network provider here at scale and subsequently has costs which are higher than expected? Who pays if Babylon doesn’t have the cash?

Is Babylon essentially an insurer here without the capital holding requirements you would expect of an insurer? Or does being risk bearing come to mean there are capital requirements? If so, is this need for capital accounted for in growth plans?

I hope you enjoyed this material. Like all parts of healthcare, this area is very complex and I can’t imagine that I understand it fully or even mostly. I’d love to hear what you think about this - especially if you see some things I’m missing or areas where I’ve misunderstood the opportunity or materials here.

What could possibly go wrong....

Brilliant - and now we can see the end results - all the insiders sold off the stock the second the lock-in period ended... Babylon raised over $1B and is now worth a total of $750M...

https://www.marketwatch.com/story/babylon-holdings-down-46-271650650648